We cleanse, enrich and categorize transaction data, adding context for you to build on.

We cleanse, enrich and categorize transaction data, adding context for you to build on.

SOLUTIONS

Build something amazing on our platform!

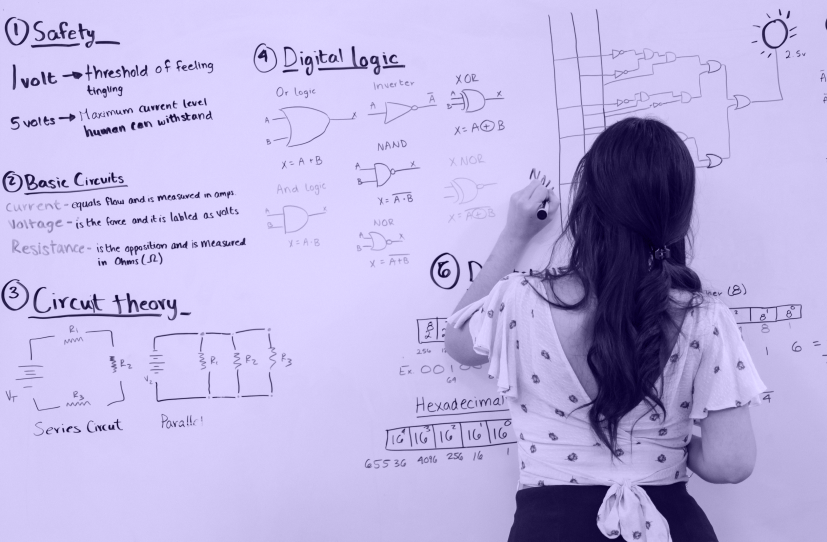

Transaction Categorization

From credit risk scoring to personal finance management, categorization is the foundational technology. Get up and running in no time using our multi-class, multi-label machine-learning based transaction categorization engine.

- Decoupled category trees

- Fast multi-class, multi-label classification

- Confidence scores for cost-based prediction

Active Learning

The meta-cognitive properties of our solutions allows the machine learning algorithm to "know when it doesn't know", allowing it to select data points for optimal training.

- Manage and extend your training data pool with samples where the model needs re-inforcement

- Cost-sensitive margin thresholds allow you to control false positive prediction rates

- Save time and money, which would otherwise be wasted effort

Entity Recognition

Recognize names and identifiers of companies, places and individuals and link them to external data sources.

- Creditor-ID expansion

- Link to external data sources

- Identify organizations by name

SERVICES

Hire us to help with the following:

Machine Learning

Experience in processing millions of transactions ranging from fraud detection and prevention, for some of the largest e-commerce providers, sporting events, and FinTech platforms, has taught us the value of practical, scalable and robust machine learning architectures.

Learn more

Blockchain & DLT

Cut through the hype to real solutions based on distributed ledger technology, from custom smart contract languages, including compiler construction and runtime, to integration with leading DLT platforms. Few can claim to have real world experience. We do.

Learn more

Privacy by Design

Data privacy in the age of analytics and machine learning requires new approaches resulting in compliant and ethical systems. With a background in cutting edge mathematical and statistical tools, we can help you achieve compliance while building great data-driven products.

Learn moreABOUT US

A bit of our story

Our philosophy

We believe that financial transaction data holds some of the most valuable insights, for both personal and business use cases, and that this enormous potential remains largely untapped, in ways which benefit the customer. As a retail banking user, having insights into my financial health, with good tools to manage my finances will make, what is probably the largest, material difference in my life. We believe that Machine Learning has been over-used, to drive marketing, in order to sell people more stuff which they don't need. We want to change that. We are here to help banks and financial institutions become true champions for their customers.